Consumer confidence, email, retail sales: 5 interesting stats to start your week

We arm you with all the stats you need to prepare for the coming week and help you understand the big industry trends.

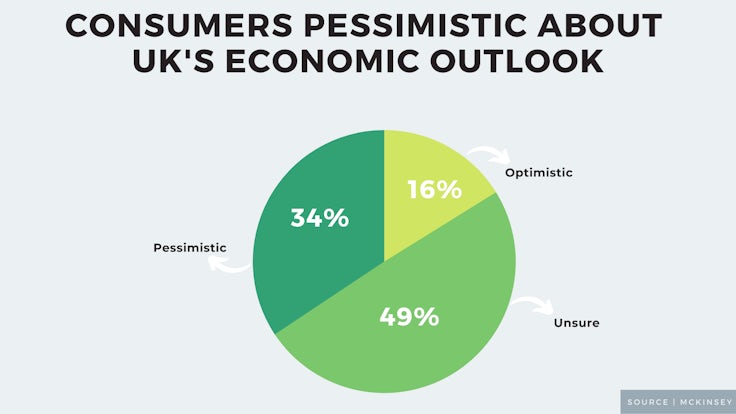

Consumers pessimistic about UK’s economic outlook

Consumers pessimistic about UK’s economic outlook

UK consumers are more pessimistic than optimistic about the country’s economic recovery in the long-term after the Covid-19 outbreak.

Some 16% are defined as ‘optimistic’ – believing the economy will rebound within two or three months and grow as strongly or stronger than before the outbrak. Almost half (49%) are defined as ‘unsure’, meaning they believe the economy will impacted for six to 12 months and stagnate or show slow growth thereafter.

A further 34% are ‘pessimistic’, believing that Covid-19 will have a lasting impact on the economy and could lead to a length recession.

Around 70% of consumers believe their routines will be impacted by more than two months, with 35% seeing a reduction in household incomes and 41% a reduction in household spending. Some 35% agree that uncertainty about the economy is preventing them from making purchases, with 51% saying they have to be “very careful” about how they spend.

Source: McKinsey

Consumers want to hear from brands despite coronavirus outbreak

Consumers want to hear from brands even if they operate in a category that may not seem so relevant during the coronavirus outbreak.

Consumers want to hear from brands even if they operate in a category that may not seem so relevant during the coronavirus outbreak.

Some 33% want to hear more from healthcare and pharma brands, 30% from supermarkets and 28% from food and drink brands. However, 34% of consumers said they want to hear less from gym and fitness brands, 39% from fashion and beauty brands, and 31% from automotive.

Consumers also have a positive perception of sectors such as supermarkets and healthcare that have been vocal about their response. While automotive (27%), fashion and beauty (26%), gym and fitness (17%), financial services (15%) and charities (14%) are perceived as not having done anything in response.

When communicating, consumers want to hear from employees on the front line (38%), the CEO/founder (31%), third-party experts (15%), influencers (5%) and celebrities (5%).

Some 70% of consumers are looking for ways to keep some normality in their lie, while 59% say they miss having conversations that don’t involve the pandemic.

Source: Opinium

Consumers more trusting of TV than digital ads

Two times more consumers says TV ads provide a positive impression of brands than common digital formats.

Two times more consumers says TV ads provide a positive impression of brands than common digital formats.

More than a third of consumers (37%) feel digital ads are too intrusive.

Some six in 10 consumers say they are less inclined to use a product if their data is used for any purpose, while 56% want more control over their data.

Source: GroupM

Consumers and marketers at odds over effectiveness of email campaigns

Consumers and marketers all too often have different views over the effectiveness of different email campaigns.

Consumers and marketers all too often have different views over the effectiveness of different email campaigns.

Some 49% of marketers believe discounts and offers are effective, compared to 65% of consumers, while just 31% of marketers think email receipts are useful compared to 59% of consumers.

Only among advice, information or tutorial emails do marketers’ views come ahead of consumers’, with 45% of marketers liking them compared to 34% of consumers.

Source: DMA

Retail sales set to plunge in 2020

The UK retail industry is predicted to lose £12.6bn in revenues this year due to the impact of the coronavirus pandemic. That means the industry will see revenues decline by 1.7% year on year in 2020 to £333.7bn, down from a previous forecast of 2% growth.

The UK retail industry is predicted to lose £12.6bn in revenues this year due to the impact of the coronavirus pandemic. That means the industry will see revenues decline by 1.7% year on year in 2020 to £333.7bn, down from a previous forecast of 2% growth.

Clothing and footwear brands are expected to be worst hit, with sales down 20.6%, compared to a previous forecast of 0.6% growth.

By comparison, grocery will see “unprecedented” growth, with revenue up 7.1% in 2020. Previously, it was forecast the market would grow by 1.2%.

Source: GlobalData

Consumers pessimistic about UK’s economic outlook

Consumers pessimistic about UK’s economic outlook